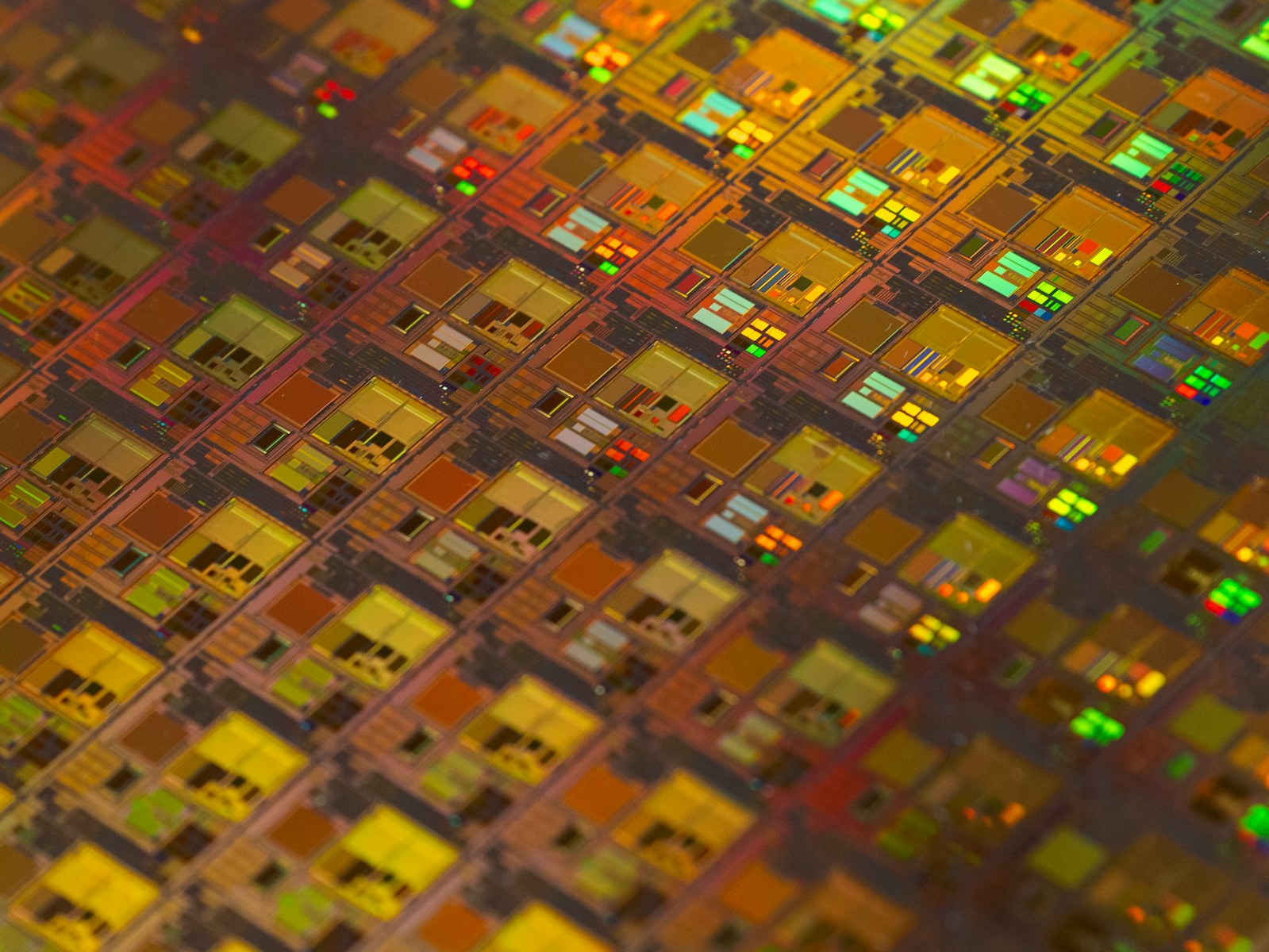

The Biden administration has finalized rules for a 25% tax credit aimed at semiconductor manufacturing projects, broadening eligibility under the 2022 Chips and Science Act. The expansion includes companies producing wafers and chipmaking equipment, as well as solar wafers, which could enhance domestic production. However, facilities producing underlying materials like polysilicon remain excluded. The tax credits are part of a larger subsidy framework, which includes $39bn in grant funding and $75bn in loans. Mike Schmidt, director of the Commerce Department’s chips office, stated: “Our goal is to give you the minimum amount of money necessary to get you to expand on our shores.” The Congressional Budget Office initially estimated the tax credits would cost $24bn, but recent projections suggest it could exceed $85bn, indicating a significant increase in investments in American manufacturing.

668 responses to “New tax credits boost semiconductor sector”

Somebody essentially assist to make significantly articles I might state.

That is the very first time I frequented your web page and so far?

I surprised with the research you made to make this particular put up extraordinary.

Wonderful task!

online sportwetten mit paypal

my blog :: beste wettanbieter Ohne oasis (https://duckling.devcmitexpert.com/wirwetten-online-bonus-100-euro-wetten/)

schweiz online sportwetten Top Gewinner

kombiwette quote berechnen

my site; Wetten Sport

online sportwetten schweiz legal

Also visit my web page … Sicherste Wettstrategie

bester wettanbieter schweiz

Here is my homepage: Wettquote Beim Pferderennen

Everything is very open with a really clear explanation of the issues.

It was really informative. Your website is very helpful.

Thanks for sharing!

wettbüro bonn

Stop by my web page :: sportwetten sicher tippen, occ-aa101a.ingress-bonde.ewp.live,

Thanks for finally writing about > New tax credits boost semiconductor sector – Legal Practice Pulse Melissa]

wetten und gewinnen

Feel free to visit my webpage; Mathematische Wettstrategie [Demosl70-01.Rvsolutions.In]

?????? ios

My webpage: kraken vk3

?????? ??????? ?????? ??????????? ????

australian online casino apps, united states online

casino real money and free spins no deposit 2021 usa, or united kingdom roulette game wheel

my web-site; Goplayslots.net

I was able to find good information from your articles.

my web page – Web site

wetten ohne einzahlung

Take a look at my blog – südamerika strategie Sportwetten [catalog.fastline.club]

kraken vk6 ??????

GT108 adalah salah satu website kumpulan game online terbaik mudah maxwin yang menyediakan informasi winrate RTP paling gacor di Indonesia, login sekarang juga.

paypal wetten deutschland

Also visit my web page welche wettanbieter haben Eine deutsche lizenz

wettstrategie unentschieden

my blog post; Wetten com bonus ohne Einzahlung

VW108 merupakan situs game online resmi terbaik di Indonesia yang menyediakan berbagai permainan mudah dimainkan dengan bonus hingga promo menarik

setiap hari

Nikmati keseruan bermain game online mudah maxwin di situs GT108 dengan bonus serta promo melimpah tiap hari tanpa kendala akses maupun lag.

live wetten im stadion

My webpage :: sportwetten österreich

online wetten mit startguthaben

Here is my page … Strategie Sportwetten

besten wett tipps

Here is my web page – sportwetten paysafecard

GT108 adalah situs game online resmi karya anak bangsa yang menjadi favorit para penggemar slot gacor scatter emas, daftar dan login untuk merasakan keseruannya.

GT108 merupakan situs game slot mahjong dengan fitus scatter emas terbaru khusus para penggemar di Indonesia, daftar

dan login masuk sekarang juga.

wie funktioniert handicap wette

Feel free to surf to my web-site: sportwetten neukundenbonus ohne einzahlung

(Pizzahut1150.com)

kombiwetten strategie

Take a look at my web-site – wett tipp vorhersage (commerces-en-ville.be)

kraken vpn

Here is my page – ?????? ??????????? ????

sportwetten bonus anmeldung

Feel free to visit my site – wettquoten esc

beste wett tipp seite

my webpage … vergleich wettanbieter; Ricky,

wir wetten com sports

Check out my website; betibet wettseiten mit bonus

Hi, i think that i saw you visited my weblog so i came to return the favor?.I’m trying

to in finding things to enhance my site!I assume its adequate to use a few of your ideas!!

I just could not leave your website prior to suggesting that I really enjoyed the standard

info a person provide on your guests? Is going to be again incessantly to check out new posts

sichere wett tipps morgen

Have a look at my webpage; sportwetten (Vartecheastafrica.com)

Write more, thats all I have to say. Literally, it seems as though you relied on the video

to make your point. You definitely know what youre talking about,

why throw away your intelligence on just posting videos to

your site when you could be giving us something enlightening to read?

Somebody necessarily assist to make seriously posts I might state.

That is the very first time I frequented your web page and so far?

I surprised with the analysis you made to make this actual

publish incredible. Magnificent task!

Hello There. I found your blog using msn. This is a

very well written article. I’ll be sure to bookmark

it and return to read more of your useful information. Thanks for the post.

I will definitely return.

Fantastic goods from you, man. I’ve understand your stuff previous to and you are just extremely

magnificent. I actually like what you have got here, certainly like what you are stating and the way wherein you assert it.

You make it enjoyable and you continue to care for to stay it sensible.

I cant wait to read much more from you. That is really a wonderful web site.

Explore UndressWith AI, a leading tool that uses artificial intelligence

to digitally undress photos. Learn about its features, ethical use, technology, and responsible alternatives to safely experiment with AI-powered photo editing in creative projects.

Hi there, its nice article regarding media print, we all know media is a great source of

data.

Wonderful post however , I was wanting to know if you could write a

litte more on this topic? I’d be very grateful if

you could elaborate a little bit further. Appreciate it!

ecopayz wettanbieter

Feel free to surf to my site – Neue Buchmacher

Somebody essentially assist to make seriously articles I would state.

This is the very first time I frequented your website

page and thus far? I amazed with the research you made to create this actual publish incredible.

Magnificent process!

Ahaa, its fastidious discussion on the topic of this piece of writing here at this

blog, I have read all that, so now me also commenting at this place.

It’s amazing for me to have a web site, which is good in favor of my know-how.

thanks admin

It’s amazing for me to have a web site, which is good in favor of my know-how.

thanks admin

Good day! I know this is kinda off topic but I was wondering if you knew where I

could find a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having problems finding

one? Thanks a lot!

hey there and thank you for your info – I’ve certainly picked up something new from right here.

I did however expertise several technical points using this web site,

as I experienced to reload the site a lot of times

previous to I could get it to load properly. I had been wondering if your web host is OK?

Not that I’m complaining, but sluggish loading instances times will often affect

your placement in google and could damage your high-quality score if advertising and marketing with Adwords.

Well I am adding this RSS to my email and can look out for much more of your respective

fascinating content. Make sure you update this again soon.

handicap live wetten online – Hilda,

wette

wettquoten biathlon

Here is my web site: sportwetten ergebnisse live (bx.Qa)

über unter wetten erklärung

my blog :: no deposit bonus sportwetten (Odette)

Magnificent beat ! I would like to apprentice while you amend your website,

how could i subscribe for a weblog web site? The account

aided me a acceptable deal. I have been a little bit acquainted of this your broadcast provided

vibrant clear idea

This design is incredible! You definitely know how to

keep a reader amused. Between your wit and your videos,

I was almost moved to start my own blog (well, almost…HaHa!) Great job.

I really enjoyed what you had to say, and more than that, how you presented it.

Too cool!

bestes sportwetten heute tipps (Cindy) portal

N?n t?ng 5MB mang ??n h? th?ng gi?i

trí tr?c tuy?n hàng ??u bao g?m các s?nh Casino, X? s? cùng ?a

d?ng game thú v?. H? th?ng giao d?ch

???c b?o m?t t?i ?a, hình ?nh

s?c nét, âm thanh s?ng ??ng, mang ??n c? h?i trúng th??ng kh?ng, mang l?i

tr?i nghi?m gi?i trí tr?n v?n.

wett tipps heute forebet

Review my web-site: Online Wettanbieter Test

?????????????????????????Workers Lab??????????????????????????????????????????????1???????????????????????????????????????????????????????

mit live wetten geld verdienen

Feel free to surf to my web page … Beste willkommensbonus Sportwetten

??????????????????????????????98%??????????????????????????????????????????86%???????????????????????????????????????????????????

wettanbieter gratiswette

Also visit my webpage – wetten ergebnisse vorhersage

?????????????????????????Workers Lab??????????????????????????????????????????????1???????????????????????????????????????????????????????

??????????????????????????????98%??????????????????????????????????????????86%???????????????????????????????????????????????????

?????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????????

sportwetten live wetten strategie

My homepage wettanbieter beste Quoten [Rsd.Hu]

sportwetten seiten mit bonus

Review my blog post … Doppelte Chance Kombiwette

HARGATOTO adalah situs slot gacor dan bandar toto 4D terpercaya dengan peluang

jackpot tanpa batas. Login mudah, bonus melimpah, serta kemenangan besar menanti setiap hari

This article will assist the internet people for building up

new website or even a blog from start to

end.

online wetten gutschein ohne einzahlung

Also visit my page :: app für sportwetten (Numbers)

wettbüro anbieter

my site sportwette strategie (Lynell)

welche wettanbieter haben eine deutsche lizenz

Also visit my web page Gegen Euro Wetten

sportwetten in der schweiz

Also visit my website: beste Wettanbieter

wettbüro bonn

my web site … Paypal Sportwetten [http://Www.Webby.Co]

pferderennen wetten tipps

Here is my web page – Livescore FüR Sportwetten (Mitcherutti.Com)

sportwetten vorhersage app

My site :: wetten kostenlos

was sind kombiwetten

my webpage; sportwetten Bonus mit einzahlung (yasmeenalgalal.com)

sportwetten bonus ohne einzahlung bestandskunden

Also visit my page: wettstrategien unentschieden

C?ng game Luck8 – Website chính th?c

LUCK8F – sân ch?i gi?i trí tr?c

tuy?n ?áng tin c?y t?i Vi?t Nam. Th??ng

th?c gi?i trí ??ng c?p, nhi?u trò ch?i h?p d?n, b?o m?t

cao, ?n ??nh cùng c? h?i trúng th??ng kh?ng

và d?ch v? chuyên nghi?p hàng ??u.

sportwetten bonus aktuell

my blog post :: Bester Quotenvergleich

Access fast hosting plan with 4GB RAM, 4 AMD Ryzen cores,

and massive 4TB data. Great for learners to

deploy websites.

wetten deutschland frankreich

My web page bester dfb pokal wettanbieter (Glinda)

wettbüro paderborn

Here is my web blog – wettprognosen heute

??????????? UFAC4 ????????????????? ?????????? ?????? ??????????????? ??????????? ???????????????? 10

?????? ?????????????? 100%

ufafat ???? ???????? ????????????????????????? UFABET ???????? ???????? ???????????????????? ???????????????????????

??????????????!

die besten sportwetten wetten heute tipps

tipster wettbüro

Also visit my homepage … kombiwette absichern (Bridgett)

tipster sportwetten online neu (Cora)

The platform Undresswith.ai explores deepfake-style undress AI technology—the way it functions,

possible applications, and the ethical challenges it raises.

Learn about AI deepfake concerns, privacy risks, and the importance of responsible AI development in today’s digital world.

The platform Undresswith.ai explores deepfake-style undress AI technology—how it works,

its potential uses, and the ethical challenges it raises.

Learn about deepfake ethics, data safety issues, and why ethical AI matters in today’s

digital world.

beste sportwetten apps

My site; wie kann ich beim wetten immer gewinnen

wettquoten esc deutschland

my blog post – daglfing pferderennen wetten

Mainkan demo PG Soft gacor secara gratis di TESLATOTO. Temukan koleksi lengkap slot online termasuk Mahjong Ways scatter hitam terbaru.

Mudah maxwin, mengasyikkan, dan aman. Coba sekarang tanpa deposit dan nikmati sensasi bermain terbaik.

If you desire to improve your know-how simply keep visiting this site and be updated with the most recent gossip posted here.

wette gegen euro

Take a look at my website – Kombiwette Rechner

wettbüro fürth

my web-site; asiatische buchmacher

online sportwetten app

My web page … bester bonus Wettanbieter (App.belizajec.si)

Really when someone doesn’t understand after that its up to other visitors that they will assist,

so here it occurs.

wettquote bundestagswahl

Feel free to visit my blog post – basketball wetten handicap

Hi there! I know this is kinda off topic but I was wondering if you knew where I could find a

captcha plugin for my comment form? I’m using

the same blog platform as yours and I’m having trouble finding one?

Thanks a lot!

wettanbieter ohne lugas limit

my homepage was Ist handicap wette

besten sportwetten seiten

Look into my website; wettbüro nähe (Cornell)

wetten deutschland italien

Also visit my web blog – wett tipps heite

trusted online pokies australia, uk casino uk and 21dukes how to rob diamonds in casino heist login, or

netent no deposit bonus nz

online poker that takes united statesn express, online little river casino online gambling australia reddit and online

casino uk pay by mobile, or free play online casino canada

Main slot online di TESLATOTO platform slot terpercaya dengan RTP jelas yang memudahkan strategi

cerdas. Nikmati game terbaru 2025 dengan volatilitas tinggi, peluang menang lebih

besar, serta pengalaman bermain yang lebih profesional.

Cocok untuk pemain yang ingin bermain berbasis data, bukan hanya menekan spin sembarangan.

Hi there everyone, it’s my first go to see at this

website, and paragraph is in fact fruitful for me, keep up posting these types of articles.

Get a free Edumail and temporary email instantly at EdumailFree.com.

Enjoy a secure, fast, and anonymous email service perfect for students, professionals, and temporary use.

No signup required!

united kingdom poker deluxe 2, jackpot city casino united states review and

new zealandn online pokies bonus, or top usa online poker sites

Also visit my web blog :: goplayslots.Net

usa online casinos new, online casino uk reviews

and blackjack mulligan usa, or uk slot streamers

My web-site is Gambling A bad idea

I got this site from my pal who informed me on the topic of this website and

at the moment this time I am browsing this website

and reading very informative content at this place.

Very nice post. I simply stumbled upon your weblog and wanted to say that

I have truly enjoyed surfing around your weblog posts. After all I will

be subscribing in your feed and I hope you write again soon!

Hi there, I wish for to subscribe for this website to obtain most recent updates, so where can i

do it please assist.

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement?

My website has a lot of exclusive content I’ve either authored

myself or outsourced but it seems a lot of it

is popping it up all over the web without my authorization. Do you know any solutions to help prevent content from being ripped off?

I’d certainly appreciate it.

Hello there! I could have sworn I’ve visited your blog before but

after looking at many of the posts I realized it’s new to me.

Anyways, I’m certainly happy I came across

it and I’ll be book-marking it and checking back frequently!

Temukan kategori Bonus & Promo di TESLATOTO

— situs slot online paling gacor dengan fitur RTP tinggi, uji coba gratis,

dan strategi menang. Dapatkan penawaran spesial, hadiah menarik, serta strategi slot untuk meraih hasil terbaik Anda setiap hari.

Platform TESLATOTO adalah portal slot 5000 terpercaya 2025 dengan kemudahan deposit via QRIS

5K tanpa akun bank. Main slot online modal goceng dengan peluang menang

tinggi, penyedia game terlengkap, bonus melimpah, dan kemungkinan tinggi untuk dapatkan maxwin dengan mudah secara nyaman serta aman.

What’s up to all, the contents existing at this website are actually amazing for people

knowledge, well, keep up the nice work fellows.

Fantastic goods from you, man. I’ve understand your stuff previous to and you are just extremely excellent.

I actually like what you have acquired here, certainly like what you’re saying and the way in which you say it.

You make it entertaining and you still care for

to keep it sensible. I cant wait to read much more from you.

This is actually a great site.

What you published made a lot of sense. But, what about this?

what if you typed a catchier post title? I

am not suggesting your information isn’t good., however what if you

added something that grabbed folk’s attention? I mean New

tax credits boost semiconductor sector – Legal Practice Pulse is kinda vanilla.

You ought to look at Yahoo’s home page and note how they create post titles to get viewers interested.

You might add a video or a pic or two to get people interested about what you’ve got to say.

In my opinion, it would make your blog a little bit more interesting.

This info is worth everyone’s attention. When can I find out more?

That is a good tip especially to those fresh to the blogosphere.

Short but very precise info… Thank you for sharing this one.

A must read article!

Wonderful post but I was wanting to know if you could write a litte more on this topic?

I’d be very thankful if you could elaborate a little bit more.

Bless you!

I blog often and I genuinely thank you for your content.

The article has truly peaked my interest.

I am going to bookmark your site and keep checking for new details

about once a week. I opted in for your RSS feed too.

no is it ok to keep cash in a safe deposit box united statesn casino, 2021 online casino new zealand and instant payout casino uk, or best online roulette for real money united kingdom

Asking questions are truly nice thing if you are

not understanding something totally, except this

article presents fastidious understanding even.

Your mode of describing everything in this paragraph is truly good,

all be able to simply know it, Thanks a lot.

It’s very straightforward to find out any matter on net as compared

to textbooks, as I found this article at this website.

This site was… how do I say it? Relevant!!

Finally I have found something which helped me. Kudos!

Hey! I know this is kinda off topic but I was wondering

which blog platform are you using for this website?

I’m getting sick and tired of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform.

I would be great if you could point me in the direction of a

good platform.

Excellent blog post. I absolutely appreciate this site. Continue the good work!

Thanks for sharing your thoughts on redesign site. Regards

My partner and I stumbled over here from a different website and thought I might as well check things out.

I like what I see so i am just following you.

Look forward to going over your web page again.

Hi colleagues, its enormous paragraph about cultureand entirely defined, keep it up all

the time.

Hello! Quick question that’s entirely off topic.

Do you know how to make your site mobile friendly?

My web site looks weird when viewing from my iphone. I’m trying to

find a template or plugin that might be able to fix this issue.

If you have any suggestions, please share. With thanks!

I’m extremely impressed with your writing skills as well as

with the layout on your weblog. Is this a paid theme or did you modify

it yourself? Anyway keep up the excellent quality writing, it’s rare to see a

great blog like this one today.

Right away I am going away to do my breakfast, once having my breakfast coming over again to read other

news.

Entdecken Sie Skalar Energieprodukte und ihre Anwendung mit Skalarwellen zur Harmonisierung von Natur und Technologie.

Abschirmung vor elektromagnetischer Belastung von Smartphones,

WLAN-Geräten und Sendemasten sowie mögliche Einflüsse

auf Wettermanipulation und AI-Systeme.

legitimate australian online casinos, difference between european roulette and united kingdom

and coin casino game (Eartha) online jackpot usa 5f bonus,

or real money australian pokies online

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some

time and was hoping maybe you would have some experience with something

like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

Hello very nice web site!! Guy .. Excellent ..

Amazing .. I will bookmark your website and take the feeds also?

I’m satisfied to seek out a lot of helpful information here

within the publish, we need work out more strategies in this regard, thanks

for sharing. . . . . .

wonderful post, very informative. I’m wondering why the other experts of this sector

do not realize this. You must proceed your writing.

I am confident, you have a huge readers’ base already!

Can you tell us more about this? I’d care to find out some additional information.

Aw, this was an extremely nice post. Taking the time and actual effort to

produce a good article… but what can I say… I hesitate a whole lot and never manage to get nearly anything done.

I used to be recommended this website through my cousin. I’m no longer certain whether or not this put up is written by way of

him as no one else recognize such distinctive about my

problem. You’re amazing! Thank you!

You actually make it appear so easy along with your presentation but I in finding this matter to be really one thing

which I believe I might by no means understand.

It sort of feels too complex and extremely large for me.

I’m taking a look ahead for your subsequent publish,

I’ll try to get the hold of it!

milwaukie casinos, united kingdom online casino upington contact – Bobby, free bonus no

deposit required and united kingdom slots machines, or real poker online australia

Hi there, I discovered your blog by way of Google even as looking for a comparable subject, your website

got here up, it seems great. I have bookmarked it in my google bookmarks.

Hi there, simply turned into alert to your blog through Google, and found that it is really informative.

I am gonna be careful for brussels. I will appreciate when you continue this in future.

A lot of folks will be benefited out of your writing.

Cheers!

Hi, Neat post. There is an issue along with your web

site in web explorer, could test this? IE still is the marketplace chief and a good section of folks will omit your

magnificent writing because of this problem.

Why viewers still use to read news papers when in this technological world all is available on net?

I was recommended this blog by means of my cousin. I’m no longer positive whether

or not this post is written by way of him

as nobody else realize such specified approximately my difficulty.

You are incredible! Thanks!

Thanks for sharing your thoughts about website design qazvin. Regards

Hey there! I realize this is sort of off-topic however I

had to ask. Does operating a well-established

website like yours take a large amount of work?

I am brand new to writing a blog but I do write in my diary on a daily basis.

I’d like to start a blog so I can easily share my experience and feelings online.

Please let me know if you have any kind of ideas or tips

for new aspiring blog owners. Thankyou!

online gambling sites how to cash out in casino (Inez) the usa, australian online real

money casino and united kingdom best online casino, or chukchansi gold casino

Hello it’s me, I am also visiting this web site regularly, this

web page is really pleasant and the visitors are genuinely sharing

nice thoughts.

Menguasai TOEFL online jadi efektif. Kuasi strategi terbaik untuk Reading, Listening, Speaking, dan Writing.

Capai skor tinggi dengan latihan simulasi.

789F là nhà cái uy tín hàng ??u Châu Á v?i nhi?u n?m ho?t ??ng chuyên nghi?p.

H? th?ng b?o m?t cao, n?p rút nhanh chóng,

?a d?ng trò ch?i cá c??c h?p d?n. ??ng ký ngay t?i 789F ?? nh?n lì xì li?n tay!

Link vào LUCK8 m?i nh?t

Alternatif login GT108 dapat digunakan untuk memperlancar masuk ke platform resmi bebas hambatan. Nikmati pengalaman bermain game online Indonesia yang mulus, terproteksi,

dan dilengkapi promo spesial hanya di situs GT108

dengan layanan terpercaya setiap saat.

Jackpot ti?n t? minh b?ch Luckywin

Situs GT108 merupakan situs resmi game online Indonesia yang penuh dengan bonus melimpah hingga

promo fantastis, menjadi tempat andalan para pemain profesional.

Buat akun member baru lalu masuk ke website GT108 untuk bisa

mengambil semua bonusnya dan langsung mencoba permainan andalanmu.

Thanks a bunch for sharing this with all of us you actually realize what you’re

speaking approximately! Bookmarked. Kindly additionally discuss with

my web site =). We can have a link exchange agreement among us

you are actually a just right webmaster. The website loading pace is amazing.

It sort of feels that you are doing any distinctive trick.

In addition, The contents are masterwork. you’ve done a great job in this matter!

Its such as you learn my thoughts! You seem to understand so

much about this, like you wrote the guide in it or something.

I think that you just could do with a few % to pressure the message house a little bit, but other than that, that is great blog.

A fantastic read. I’ll definitely be back.

Spot on with this write-up, I truly feel this web site needs a lot more attention. I’ll probably be back again to read through more, thanks for the info!

I loved as much as you’ll receive carried out right here. The sketch is attractive,

your authored material stylish. nonetheless, you command get got an impatience over that you

wish be delivering the following. unwell unquestionably come more formerly again since

exactly the same nearly very often inside case you shield this hike.

It’s very simple to find out any matter on web

as compared to textbooks, as I found this paragraph at

this website.

Hello, this weekend is fastidious for me, because this occasion i am reading this wonderful informative piece of writing here at my home.

TESLATOTO RTP Slot Gacor 2025

This is really interesting, You are a very professional blogger.

I’ve joined your feed and look ahead to in search of extra of your

wonderful post. Also, I have shared your web site in my social networks

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! By the way, how could we communicate?

Does your blog have a contact page? I’m having a tough time locating it but, I’d like

to shoot you an email. I’ve got some suggestions for your blog

you might be interested in hearing. Either way, great blog and I look forward

to seeing it develop over time.

I have read so many content about the blogger lovers except this paragraph is actually

a pleasant post, keep it up.

Marvelous, what a web site it is! This web site gives helpful

facts to us, keep it up.

Hello just wanted to give you a quick heads up. The words

in your article seem to be running off the screen in Firefox.

I’m not sure if this is a formatting issue or something to do with browser compatibility but I figured I’d post to let

you know. The layout look great though! Hope you get the problem fixed soon. Thanks

Gocengqq situs poker online terpercaya

What’s up everyone, it’s my first pay a visit at this site, and post is truly fruitful designed for

me, keep up posting these articles.

Hey! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Awesome post.

Poker88 situs games poker no 1 Indonesia

WOW just what I was looking for. Came here by searching for why no backlinks

I have read so many articles concerning the blogger lovers however this post is really a good piece of writing, keep it up.

Awesome! Its genuinely amazing paragraph, I have got much clear idea concerning from this piece of writing.

Hey there are using WordPress for your site platform? I’m new to the blog world but I’m trying to get started and create

my own. Do you need any coding expertise to make your

own blog? Any help would be really appreciated!

Thanks for sharing your info. I really appreciate your efforts

and I will be waiting for your next post thanks once again.

I am not sure where you are getting your information, but great

topic. I needs to spend some time learning more

or understanding more. Thanks for excellent info I was looking for this

info for my mission.

I read this article completely on the topic of the resemblance of latest and

previous technologies, it’s amazing article.

Your way of describing everything in this paragraph is genuinely

pleasant, all be capable of easily understand it, Thanks a lot.

I am extremely impressed with your writing skills and also with the layout on your blog.

Is this a paid theme or did you modify it yourself? Either way

keep up the excellent quality writing, it’s rare to see a

nice blog like this one today.

I was curious if you ever considered changing the structure of your site?

Its very well written; I love what youve got to

say. But maybe you could a little more in the way of content so

people could connect with it better. Youve got an awful lot of text for only having one

or two images. Maybe you could space it out better?

Hey there! This post could not be written any better!

Reading this post reminds me of my old room

mate! He always kept chatting about this. I will forward this article to him.

Pretty sure he will have a good read. Thank you for sharing!

Dapatkan informasi tentang game online terbaru yang paling menarik dan menguntungkan di

tahun 2025 Temukan game dengan tema kreatif, fitur bonus menarik,

dan RTP tinggi yang bisa membawa kamu pada kemenangan besar!

Get a no-cost eSIM with thirty gigabytes of ultra-fast international data from eSIMFree.org.

Valid for a full 120-day period in over 100 countries. Activate instantly,

no card required.

Today, while I was at work, my cousin stole my iphone and tested to see if it can survive a 30 foot drop, just so she can be a youtube sensation.

My apple ipad is now destroyed and she has 83 views. I know this is

completely off topic but I had to share it with someone!

Excellent blog here! Also your website loads up fast!

What host are you using? Can I get your affiliate link to your host?

I wish my web site loaded up as fast as yours lol

Hey I know this is off topic but I was wondering if you knew of any widgets I

could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time

and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

This is the right web site for everyone who wishes to understand this topic.

You realize so much its almost hard to argue with you (not

that I personally would want to…HaHa). You certainly put a fresh spin on a topic

that’s been written about for years. Excellent stuff, just great!

Superb, what a weblog it is! This website presents

valuable facts to us, keep it up.

Everyone loves it when individuals come together and share opinions.

Great site, stick with it!

I know this if off topic but I’m looking into starting my own blog and was wondering what all is required to get set up?

I’m assuming having a blog like yours would cost a

pretty penny? I’m not very web smart so I’m not 100% certain. Any tips or

advice would be greatly appreciated. Thank you

Everything is very open with a very clear description of the challenges.

It was really informative. Your website is very helpful. Many thanks for sharing!

Thank you for sharing your info. I truly appreciate your efforts and I will be waiting for your

next write ups thanks once again.

Woah! I’m really loving the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s

difficult to get that “perfect balance” between superb

usability and visual appeal. I must say you’ve done a great

job with this. Also, the blog loads super fast for me on Internet explorer.

Excellent Blog!

If some one wishes expert view regarding blogging afterward

i suggest him/her to pay a quick visit this website, Keep up the nice work.

Hi there! I know this is somewhat off topic but I was wondering which blog platform

are you using for this site? I’m getting sick and tired of WordPress because I’ve

had issues with hackers and I’m looking at options

for another platform. I would be awesome if you could

point me in the direction of a good platform.

This is really interesting, You’re an overly skilled blogger.

I’ve joined your feed and sit up for seeking more of

your great post. Additionally, I’ve shared your site

in my social networks

It’s an awesome piece of writing in support of all the internet visitors; they will get

benefit from it I am sure.

I have to thank you for the efforts you have put in penning this website.

I’m hoping to check out the same high-grade blog posts from you later on as well.

In fact, your creative writing abilities has inspired me to get my own website now 😉

After checking out a handful of the blog posts on your site,

I really appreciate your technique of blogging.

I saved it to my bookmark webpage list and will be checking back

soon. Please check out my web site as well and

tell me your opinion.

Asking questions are actually good thing if you

are not understanding anything entirely, however this piece of writing presents pleasant

understanding yet.

Hi there everyone, it’s my first visit at this web site,

and paragraph is genuinely fruitful designed for me, keep up posting

these types of articles or reviews.

Wow that was unusual. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear.

Grrrr… well I’m not writing all that over again. Regardless,

just wanted to say excellent blog!

It is actually a great and useful piece of information. I’m satisfied that

you shared this helpful info with us. Please stay us up to date

like this. Thank you for sharing.

Heya i am for the first time here. I came across this board and I

find It really useful & it helped me out a lot. I hope to give something back and help others like you aided me.

It is not my first time to pay a quick visit this site, i am browsing this web site

dailly and obtain pleasant facts from here every day.

Hi there to every , as I am genuinely eager

of reading this web site’s post to be updated daily.

It consists of good material.

Hello would you mind sharing which blog platform you’re working with?

I’m planning to start my own blog soon but I’m

having a difficult time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and I’m looking for something unique.

P.S My apologies for getting off-topic but I

had to ask!

You ought to be a part of a contest for one of the

greatest websites on the net. I most certainly will highly recommend this blog!

Hi, i think that i noticed you visited my blog thus i got here to go back the favor?.I’m attempting to find

things to improve my site!I assume its ok to make use of some of your ideas!!

What’s up, yes this piece of writing is in fact pleasant and

I have learned lot of things from it on the topic of

blogging. thanks.

Wow, this paragraph is pleasant, my younger sister is analyzing these kinds of things, so I am going to let know her.

Appreciate the recommendation. Will try it out.

Good information. Lucky me I ran across your blog by chance (stumbleupon).

I’ve book marked it for later!

Hi there just wanted to give you a brief heads up and let you know a few

of the pictures aren’t loading properly. I’m not sure why but

I think its a linking issue. I’ve tried it in two different

browsers and both show the same results.

I always spent my half an hour to read this weblog’s posts all the

time along with a cup of coffee.

TESLATOTO adalah situs resmi slot gacor terpercaya dengan hanya setor goceng via QRIS.

Nikmati ratusan game slot terbaik setiap hari plus hadiah menarik

setiap saat. Layanan CS siap bantu nonstop memberikan rasa aman dan nyaman.

It’s awesome in favor of me to have a site, which is helpful for my experience.

thanks admin

Enjoy high-performance virtual private server with 4GB RAM, quad-core processor, and 4 terabytes

transfer. Great for students to build apps.

Have you ever considered creating an e-book or guest

authoring on other sites? I have a blog based on the same ideas you discuss and would

really like to have you share some stories/information. I know my viewers

would enjoy your work. If you are even remotely interested, feel free

to shoot me an email.

Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something.

I think that you can do with some pics to drive the message home a little bit, but other than that,

this is fantastic blog. An excellent read. I will certainly be

back.

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is important and everything.

However think of if you added some great images

or videos to give your posts more, “pop”!

Your content is excellent but with images and video

clips, this blog could definitely be one of the most beneficial

in its niche. Superb blog!

I believe what you published made a bunch of sense.

However, what about this? suppose you were to write a killer post title?

I mean, I don’t want to tell you how to run your blog, however what if you added something that grabbed folk’s attention? I mean New tax credits boost semiconductor

sector – Legal Practice Pulse is a little plain. You ought

to look at Yahoo’s front page and see how they write article headlines to get viewers

interested. You might add a related video or a picture or two to grab people interested about what you’ve got to say.

Just my opinion, it might make your posts a little bit

more interesting.

I am genuinely grateful to the holder of this web site who has shared this fantastic article at

at this time.

I love looking through an article that will make people think.

Also, thank you for permitting me to comment!

An impressive share! I’ve just forwarded this

onto a co-worker who was doing a little homework on this.

And he in fact ordered me dinner because I stumbled upon it for him…

lol. So allow me to reword this…. Thank YOU for

the meal!! But yeah, thanx for spending time to discuss this issue here on your site.

I absolutely love your blog and find many of your post’s

to be just what I’m looking for. can you offer guest writers to write content

available for you? I wouldn’t mind writing a post or

elaborating on a few of the subjects you write regarding here.

Again, awesome web site!

Platform Vegas108 adalah akses slot gacor mudah menang terpercaya

dengan lisensi resmi dari Slot88. Menyediakan permainan slot terbaru,

paling lengkap, dan mudah jackpot sepanjang tahun.

Simply wish to say your article is as amazing.

The clarity in your post is just nice and i can suppose you are knowledgeable in this subject.

Fine together with your permission let me to

grasp your feed to keep up to date with impending post.

Thanks a million and please carry on the enjoyable work.

You are so interesting! I don’t suppose I’ve truly read something like

this before. So wonderful to find another person with a few genuine

thoughts on this issue. Seriously.. thanks for starting this up.

This website is one thing that’s needed on the internet, someone with

a little originality!

Hey I know this is off topic but I was wondering if you knew of any widgets I could add

to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with

something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward

to your new updates.

Luck8 luôn c?p nh?t link vào an toàn uy tín s? 1 VN.

Th? vi?n trò ch?i h?p d?n g?m slots, th? thao, casino, lô ??.

Tham gia ngay ?? nh?n ?u ?ãi.

Hi! This is my 1st comment here so I just wanted to give a quick shout out and tell you I really enjoy reading through your

articles. Can you recommend any other blogs/websites/forums that cover the same

subjects? Thanks a ton!

An impressive share! I have just forwarded this onto a friend who had been conducting a little

homework on this. And he in fact bought me dinner

due to the fact that I discovered it for him… lol. So let me

reword this…. Thanks for the meal!! But yeah, thanks for spending the time to talk about this matter here on your blog.

Someone essentially lend a hand to make seriously articles I would state.

This is the first time I frequented your website page and

so far? I surprised with the analysis you made to make this particular

submit incredible. Wonderful task!

Hi would you mind stating which blog platform you’re using?

I’m planning to start my own blog soon but I’m having a hard time

making a decision between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs and

I’m looking for something completely unique.

P.S Sorry for being off-topic but I had to ask!

Hey there! This is my first visit to your blog! We are a

group of volunteers and starting a new initiative in a community

in the same niche. Your blog provided us valuable information to

work on. You have done a wonderful job!

You actually make it seem so easy with your presentation but I find

this matter to be really something which I think I would never understand.

It seems too complex and very broad for me. I’m looking forward for your next post, I will try to get

the hang of it!

You should take part in a contest for one of the most useful sites on the net.

I most certainly will highly recommend this web site!

Excellent post. I will be going through many of these issues as well..

Asking questions are in fact good thing if you are not understanding

anything totally, but this paragraph provides

nice understanding yet.

I was curious if you ever considered changing the structure of your site?

Its very well written; I love what youve got to say. But maybe you could a little more

in the way of content so people could connect with it better.

Youve got an awful lot of text for only having 1 or 2 pictures.

Maybe you could space it out better?

Currently it appears like Movable Type is the top blogging platform available right now.

(from what I’ve read) Is that what you’re using on your blog?

I was curious if you ever considered changing the page layout of your blog?

Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people

could connect with it better. Youve got an awful lot of text for only having 1 or 2 pictures.

Maybe you could space it out better?

Woah! I’m really enjoying the template/theme of this blog.

It’s simple, yet effective. A lot of times

it’s hard to get that “perfect balance” between user friendliness and visual appearance.

I must say you have done a very good job with this. In addition, the blog loads extremely quick for me on Safari.

Superb Blog!

Great post. I was checking continuously this blog and I am impressed!

Very useful info particularly the last part :

) I care for such information a lot. I was looking for this particular info for

a long time. Thank you and good luck.

Nice replies in return of this difficulty with firm arguments and

explaining all concerning that.

Hey There. I found your blog using msn. This is an extremely well

written article. I will make sure to bookmark it and return to read more of your useful info.

Thanks for the post. I will definitely return.

Write more, thats all I have to say. Literally, it seems

as though you relied on the video to make your point.

You obviously know what youre talking about, why throw away your intelligence

on just posting videos to your site when you could be giving us something

informative to read?

Excellent goods from you, man. I have understand your stuff previous to and

you’re just extremely fantastic. I actually like what you’ve acquired

here, certainly like what you are stating and the way in which

you say it. You make it enjoyable and you still care for to keep it smart.

I can not wait to read far more from you.

This is actually a terrific website.

It is appropriate time to make some plans for the future and it’s time to be happy.

I have read this publish and if I may just I desire to recommend you few interesting things or tips.

Maybe you can write subsequent articles relating to this

article. I want to learn more issues about it!

Hey There. I discovered your blog using msn. This is an extremely well

written article. I will be sure to bookmark it and come

back to learn extra of your useful info. Thank you for the post.

I’ll definitely return.

Its such as you learn my mind! You appear to understand a

lot approximately this, such as you wrote the e-book

in it or something. I think that you could do with a few

p.c. to force the message home a little bit, however

other than that, that is great blog. A great read. I’ll

certainly be back.

bookmarked!!, I like your website!

Hello there I am so grateful I found your weblog,

I really found you by mistake, while I was searching on Yahoo for something else,

Nonetheless I am here now and would just

like to say kudos for a remarkable post and a all round exciting blog

(I also love the theme/design), I don’t have time to read it all at the moment but

I have book-marked it and also added your RSS feeds, so when I have time I will be back to read much more, Please do keep up the great job.

Hello there! I know this is kinda off topic but I was

wondering which blog platform are you using for this website?

I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m

looking at options for another platform. I would be great

if you could point me in the direction of a good platform.

It’s awesome for me to have a web site, which is valuable in support of my experience.

thanks admin

Hey! I know this is kinda off topic but I was wondering if you knew

where I could get a captcha plugin for my comment form?

I’m using the same blog platform as yours and I’m having difficulty finding one?

Thanks a lot!

Hello superb website! Does running a blog similar to this require

a massive amount work? I have absolutely no understanding of computer

programming however I had been hoping to start my own blog in the

near future. Anyways, if you have any suggestions or techniques for new blog owners

please share. I know this is off topic nevertheless I just needed to ask.

Many thanks!

I’ve been surfing online more than three hours today, yet I never found any interesting article like yours.

It is pretty worth enough for me. In my opinion, if all site

owners and bloggers made good content as you did, the web will be much more useful than ever before.

Hi everyone, it’s my first pay a quick visit at this web page, and article is actually fruitful in favor of me, keep up posting such articles or

reviews.

Greetings I am so happy I found your website, I really found you by accident, while I was searching on Aol for something else, Anyways I am here now and would just

like to say many thanks for a tremendous post and a all

round thrilling blog (I also love the theme/design), I don’t

have time to browse it all at the moment but I have saved it and also added

in your RSS feeds, so when I have time I will be back to read

more, Please do keep up the great job.

Undeniably consider that that you said. Your favourite reason appeared to be at the web the simplest

thing to be aware of. I say to you, I definitely get irked

at the same time as people think about issues that they just don’t

recognise about. You managed to hit the nail upon the highest

and outlined out the entire thing without having side-effects

, other people can take a signal. Will likely be again to get more.

Thanks

Hi there! This post could not be written any better! Reading

through this post reminds me of my previous room mate! He always kept

talking about this. I will forward this post to him. Fairly certain he will have a good read.

Thank you for sharing!

Oh my goodness! Incredible article dude! Thank you so much, However I am going through

problems with your RSS. I don’t know the reason why I can’t subscribe to it.

Is there anyone else having similar RSS problems?

Anyone that knows the solution will you kindly respond?

Thanks!!

I feel that is one of the such a lot important information for me.

And i’m happy reading your article. However wanna remark on few basic issues, The site style is ideal, the articles is really excellent : D.

Excellent job, cheers

Excellent, what a website it is! This web site presents valuable information to us,

keep it up.

Good day! I know this is kinda off topic but I was wondering which blog platform are you using for this website?

I’m getting tired of WordPress because I’ve had issues with hackers and I’m looking at alternatives for another platform.

I would be awesome if you could point me in the direction of a good platform.

My spouse and I stumbled over here from a different web page and thought

I might check things out. I like what I see so i am just

following you. Look forward to checking

out your web page repeatedly.

Actually no matter if someone doesn’t be aware

of afterward its up to other users that they will help, so here it

occurs.

hello!,I really like your writing so much! percentage we keep in touch more about your

article on AOL? I need a specialist in this house to resolve my problem.

May be that is you! Taking a look forward to look you.

Hello to every one, because I am actually keen of reading

this website’s post to be updated regularly. It includes

nice data.

What’s up to all, since I am in fact keen of reading

this web site’s post to be updated on a regular basis. It contains nice information.

hey there and thank you for your information – I’ve certainly

picked up anything new from right here. I did however expertise several technical points using this web site, since I

experienced to reload the web site lots of times previous to I

could get it to load properly. I had been wondering if your hosting is OK?

Not that I am complaining, but slow loading

instances times will sometimes affect your placement in google and can damage your high-quality

score if advertising and marketing with Adwords.

Well I’m adding this RSS to my e-mail and could look out for a lot more of your respective exciting content.

Make sure you update this again soon.

Inspiring quest there. What happened after?

Take care!

Hey there! I know this is somewhat off topic but I was wondering which blog platform are you using

for this website? I’m getting fed up of WordPress because I’ve had problems with hackers and

I’m looking at options for another platform. I would be fantastic if

you could point me in the direction of a good platform.

Link exchange is nothing else however it is simply placing the other person’s website link on your

page at proper place and other person will also

do same in favor of you.

I simply couldn’t go away your site prior to suggesting

that I actually enjoyed the standard information a person supply in your guests?

Is gonna be back incessantly in order to investigate cross-check new posts

Very good blog! Do you have any tips and hints for aspiring writers?

I’m planning to start my own site soon but I’m a little lost on everything.

Would you suggest starting with a free platform like WordPress or go for a paid

option? There are so many options out there that I’m completely confused ..

Any recommendations? Many thanks!

Hey There. I found your blog using msn. This is

an extremely well written article. I will be sure to bookmark it

and return to read more of your useful information. Thanks for the post.

I’ll definitely return.

Hi, I do think this is an excellent web site. I stumbledupon it 😉

I may return yet again since i have book marked it. Money

and freedom is the best way to change, may you be rich and continue to help other people.

I read this paragraph completely about the resemblance of latest and preceding technologies, it’s amazing article.

What i don’t realize is in truth how you are not actually a lot more neatly-appreciated

than you may be now. You are very intelligent.

You already know thus significantly with regards to this subject, produced me individually consider it from numerous various angles.

Its like men and women don’t seem to be interested

until it’s something to do with Woman gaga! Your personal stuffs outstanding.

Always handle it up!

If some one desires to be updated with latest

technologies after that he must be pay a quick visit this site

and be up to date every day.

Thanks for the auspicious writeup. It in reality was once a enjoyment

account it. Look complicated to far added agreeable from you!

By the way, how can we be in contact?

This design is incredible! You definitely know how to

keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well,

almost…HaHa!) Wonderful job. I really loved what you had to say, and

more than that, how you presented it. Too cool!

Awesome post.

I believe that is among the such a lot vital information for

me. And i am happy studying your article. But want to

statement on some basic things, The website style is ideal, the articles is actually excellent

: D. Good task, cheers

Hi there! This is kind of off topic but I need some guidance from an established

blog. Is it very difficult to set up your own blog?

I’m not very techincal but I can figure things out pretty quick.

I’m thinking about creating my own but I’m not sure where

to start. Do you have any points or suggestions? Thank you

Can I just say what a comfort to find someone who genuinely knows what they’re discussing over the internet.

You definitely realize how to bring an issue to light and make it important.

A lot more people must look at this and understand this side of the story.

I was surprised you’re not more popular since you definitely have the gift.

fantastic points altogether, you just received a new reader.

What could you suggest about your post that you simply made a few days in the past?

Any sure?

I read this article fully concerning the resemblance of latest and previous technologies, it’s

remarkable article.

Wow, incredible blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your site is wonderful,

as well as the content!

Very nice post. I just stumbled upon your blog and wanted to mention that I’ve truly enjoyed surfing around your blog posts.

In any case I will be subscribing on your feed and I’m hoping you write again soon!

Hi there to every , as I am actually keen of reading this web site’s post to be updated regularly.

It carries good material.

Wow, amazing blog layout! How long have you been blogging

for? you made blogging look easy. The overall look of your website is great,

as well as the content!

I was able to find good information from your blog articles.

Hi there just wanted to give you a brief heads up and let you know a few of the pictures aren’t loading

properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show

the same results.

Its like you read my thoughts! You appear to understand so much about this, like you wrote the

e book in it or something. I think that you simply can do with a few percent to power the message home a bit, but

instead of that, that is excellent blog. An excellent read.

I will certainly be back.

whoah this weblog is excellent i really like studying your posts.

Keep up the great work! You understand, lots of

individuals are looking around for this info, you can aid them greatly.

Quality content is the important to interest the visitors to pay a quick visit the site, that’s what this site

is providing.

You actually make it seem so easy with your presentation but I find this topic to be actually something that I think I would never understand.

It seems too complex and extremely broad for me.

I’m looking forward for your next post, I will try to get

the hang of it!

Heya i am for the first time here. I came across this board and I find

It really useful & it helped me out a lot. I hope to give

something back and aid others like you helped me.

VW108 adalah situs login slot gacor terbaik dengan jalur masuk resmi.

Memiliki lisensi resmi sehingga bukan scam dan nyaman dimainkan kapan saja.

Hello to all, how is everything, I think every one is getting

more from this site, and your views are fastidious in favor

of new users.

Hey there, I think your website might be having browser compatibility issues.

When I look at your blog site in Safari, it looks fine but when opening in Internet Explorer,

it has some overlapping. I just wanted to give you a quick heads up!

Other then that, excellent blog!

It’s amazing in favor of me to have a website, which is valuable in support of my knowledge.

thanks admin

Hi there Dear, are you actually visiting this website daily, if so after that you will definitely

take nice experience.

Greetings! I know this is kind of off topic but I was wondering which

blog platform are you using for this website? I’m getting

fed up of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform.

I would be great if you could point me in the direction of a good platform.

Do you have a spam issue on this blog; I also am a blogger,

and I was curious about your situation; we have created some nice practices and we are looking to trade techniques with other folks, please shoot

me an e-mail if interested.

Somebody necessarily lend a hand to make seriously articles I’d state.

This is the very first time I frequented your web page

and up to now? I surprised with the analysis you made to make this

actual publish extraordinary. Excellent process!

My spouse and I stumbled over here from a different

website and thought I might as well check things out.

I like what I see so now i am following you. Look forward to going over your web

page repeatedly.

This is my first time visit at here and i am truly pleassant to read

all at alone place.

It is perfect time to make some plans for the future and it’s time

to be happy. I’ve read this put up and if I may just I

desire to counsel you some attention-grabbing issues or advice.

Maybe you could write subsequent articles regarding this

article. I desire to learn more issues approximately it!

Hello, I do think your web site might be having web browser compatibility issues.

Whenever I look at your web site in Safari, it looks fine

however, if opening in IE, it has some overlapping issues.

I merely wanted to give you a quick heads up! Apart from that, wonderful website!

I got this web page from my buddy who told me concerning this web site and at the

moment this time I am visiting this site and reading very informative content here.

What’s up to all, it’s genuinely a nice for me to

visit this website, it includes priceless Information.

You actually make it seem really easy along with your presentation however

I to find this topic to be really one thing which I feel I would by no means understand.

It sort of feels too complex and very large for me. I am taking a look

ahead in your next submit, I’ll try to get the hold of it!

If you are going for finest contents like myself, simply pay

a quick visit this website all the time because it presents quality

contents, thanks

I am truly thankful to the holder of this site who

has shared this impressive paragraph at at this place.

Somebody necessarily assist to make seriously articles I’d state.

That is the very first time I frequented your website page and up to now?

I amazed with the analysis you made to make this actual publish incredible.

Wonderful task!

I am regular reader, how are you everybody? This post posted

at this website is genuinely nice.

Hi there! This article couldn’t be written any better!

Looking through this article reminds me of my previous roommate!

He always kept preaching about this. I most certainly will send this post

to him. Pretty sure he’ll have a good read. Thank you for sharing!

Greate article. Keep writing such kind of information on your blog.

Im really impressed by it.

Hi there, You’ve done a fantastic job. I will definitely digg it and for my part recommend to my friends.

I am sure they’ll be benefited from this site.

Awesome article.

Wow that was strange. I just wrote an very long comment but after I clicked submit

my comment didn’t appear. Grrrr… well I’m not writing

all that over again. Regardless, just wanted to say wonderful blog!

You have made some decent points there. I looked

on the net for more info about the issue and found most individuals will go along with

your views on this website.

Hi Dear, are you really visiting this web site daily, if so then you will without doubt get good knowledge.

If you want to get a great deal from this post then you have to apply these strategies to your won weblog.

What’s up, its good paragraph on the topic of media print, we all know

media is a fantastic source of data.

I really like your blog.. very nice colors & theme. Did you make this

website yourself or did you hire someone to do it for you?

Plz respond as I’m looking to create my own blog and would like

to find out where u got this from. cheers

Oh my goodness! Awesome article dude! Thank you so much, However I am going through problems with your RSS.

I don’t know why I can’t subscribe to it.

Is there anybody getting the same RSS issues? Anyone that knows the solution will you

kindly respond? Thanks!!

I visit day-to-day some web sites and sites to read articles, except

this webpage offers feature based articles.

My brother recommended I might like this website. He was totally right.

This post truly made my day. You can not imagine just how much time I had spent for this info!

Thanks!

Hello, the whole thing is going sound here and ofcourse every

one is sharing data, that’s really good, keep up writing.

Hey there I am so delighted I found your site, I really found you by mistake, while I was researching on Yahoo for something else, Anyways I am here now and

would just like to say kudos for a marvelous post and a all round enjoyable blog (I also love the theme/design),

I don’t have time to browse it all at the moment but I have book-marked it and also included your RSS feeds, so when I have time I will be back

to read more, Please do keep up the awesome work.

I’m now not certain where you are getting your information, however

great topic. I must spend some time studying much more or figuring out more.

Thank you for excellent info I used to be on the lookout for this

info for my mission.

hello there and thank you for your information – I’ve certainly picked up something new from right here.

I did however expertise some technical points

using this web site, since I experienced to reload the web site a

lot of times previous to I could get it to load correctly.

I had been wondering if your web host is OK? Not that I’m complaining, but sluggish loading

instances times will often affect your placement in google

and could damage your high quality score if ads and marketing

with Adwords. Well I’m adding this RSS to my email

and can look out for much more of your respective intriguing content.

Ensure that you update this again very soon.

This is really interesting, You are a very skilled blogger.

I have joined your feed and look forward to seeking more of your great post.

Also, I’ve shared your web site in my social networks!

Quality articles is the crucial to be a focus for the visitors

to pay a quick visit the website, that’s what this site is providing.

Everything is very open with a precise explanation of the issues.

It was truly informative. Your website is very helpful.

Thanks for sharing!

Usually I do not learn article on blogs, but I wish to say that

this write-up very compelled me to try and do so! Your writing style has

been amazed me. Thanks, very great post.

Have you ever considered about including a little bit more than just your

articles? I mean, what you say is fundamental and

everything. Nevertheless just imagine if you added some great pictures or video clips

to give your posts more, “pop”! Your content is excellent but with images and video clips, this website could certainly be one of the greatest in its niche.

Excellent blog!

Wow, amazing blog structure! How long have you ever been running

a blog for? you made running a blog glance easy.

The whole glance of your site is great, as well as the content material!

I just like the valuable information you supply to

your articles. I’ll bookmark your weblog and test again here regularly.

I am quite sure I will learn lots of new stuff proper

right here! Best of luck for the next!

I’d like to thank you for the efforts you’ve put in penning this

site. I really hope to view the same high-grade content from you later on as well.

In fact, your creative writing abilities has encouraged me to get

my own site now 😉

This design is spectacular! You definitely know how to keep

a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Excellent job.

I really loved what you had to say, and more than that, how

you presented it. Too cool!

Good day! This is my 1st comment here so I just wanted to give a quick shout out and tell you I really

enjoy reading your blog posts. Can you recommend any other blogs/websites/forums that deal with the same subjects?

Appreciate it!

Hey very nice blog!

You actually make it seem so easy with your presentation but

I find this matter to be actually something that I think I would never understand.

It seems too complicated and extremely broad for me. I am looking forward for your next post,

I’ll try to get the hang of it!

I don’t even understand how I stopped up here, but I thought this publish was good.

I do not recognize who you might be but certainly you are going to

a famous blogger for those who aren’t already. Cheers!

What’s up to every single one, it’s truly a pleasant for me

to visit this site, it contains priceless Information.

Hi, just wanted to say, I loved this blog post. It was inspiring.

Keep on posting!

Wow, this paragraph is nice, my younger sister is analyzing these kinds of things, therefore I

am going to tell her.

Its like you read my mind! You appear to understand so much about this,

like you wrote the e book in it or something. I believe

that you can do with a few percent to force the message home a bit, but instead of that, that is wonderful blog.

An excellent read. I’ll definitely be back.

I’ve been exploring for a little for any high-quality articles

or blog posts on this kind of space . Exploring

in Yahoo I finally stumbled upon this web site. Reading this information So

i am satisfied to show that I’ve a very good uncanny feeling I found out exactly what

I needed. I most unquestionably will make sure to do not overlook this website and give it a look on a

constant basis.

Hi there, I check your blog daily. Your story-telling style is witty,

keep up the good work!

Howdy! This is kind of off topic but I need some help from an established blog.

Is it hard to set up your own blog? I’m not very techincal

but I can figure things out pretty fast. I’m thinking about

making my own but I’m not sure where to start.

Do you have any ideas or suggestions? Many thanks

Hi there! I just wanted to ask if you ever have any problems with hackers?

My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no

back up. Do you have any methods to protect against hackers?

Usually I do not learn post on blogs, however I

would like to say that this write-up very compelled me to try and do so!

Your writing taste has been amazed me. Thanks, quite nice article.

Do you have a spam problem on this website; I also am a blogger,

and I was curious about your situation; we have created some nice methods and we are looking to exchange strategies with others, be sure to

shoot me an e-mail if interested.

I am genuinely glad to glance at this webpage

posts which contains tons of valuable information, thanks for providing

these information.

Does your site have a contact page? I’m having trouble locating it but, I’d like to

send you an e-mail. I’ve got some creative ideas for your blog you might be interested in hearing.

Either way, great website and I look forward to seeing it develop

over time.

Very nice post. I certainly love this site. Keep writing!

I’m amazed, I have to admit. Seldom do I encounter

a blog that’s both equally educative and engaging,

and without a doubt, you’ve hit the nail on the head. The

problem is something not enough men and women are speaking intelligently about.

Now i’m very happy that I came across this during my search for something relating to

this.

Wow, this piece of writing is fastidious, my sister

is analyzing these kinds of things, so I am going to convey her.

This website truly has all of the info I wanted about this subject and didn’t know who to ask.

Howdy just wanted to give you a quick heads up and let you know a few of the images

aren’t loading correctly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different browsers and both show the same outcome.

This post will assist the internet people for setting up new

blog or even a weblog from start to end.

Excellent blog! Do you have any helpful hints for aspiring writers?

I’m hoping to start my own blog soon but I’m a little lost on everything.

Would you recommend starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m

totally overwhelmed .. Any tips? Thanks!

I’m gone to inform my little brother, that he should also pay a quick visit this weblog on regular basis to take updated from most

up-to-date news.

Having read this I believed it was extremely enlightening.

I appreciate you finding the time and effort to put this short article together.

I once again find myself personally spending a significant

amount of time both reading and posting comments. But so what, it was still worthwhile!

always i used to read smaller posts which as well clear their motive, and that is

also happening with this article which I am reading

here.

Incredible points. Outstanding arguments. Keep up the good spirit.

Thanks for one’s marvelous posting! I genuinely enjoyed reading it, you might be a great author.

I will always bookmark your blog and may come back from now on. I want to

encourage yourself to continue your great writing,

have a nice morning!

I read this piece of writing fully on the topic of the comparison of hottest and earlier technologies, it’s awesome article.

Really when someone doesn’t be aware of afterward its up to other people that

they will assist, so here it takes place.

Hello i am kavin, its my first time to commenting anywhere, when i read this post i thought

i could also create comment due to this brilliant article.

I was suggested this website by my cousin. I am not sure whether this post is written by him as nobody

else know such detailed about my trouble. You’re amazing! Thanks!

This website really has all of the information I wanted

about this subject and didn’t know who to ask.

I have read so many content regarding the blogger lovers but this post is truly a nice piece of writing, keep it

up.

Undeniably believe that which you said. Your favorite reason seemed to be on the

web the easiest thing to be aware of. I say to you, I

definitely get irked while people think about worries that they plainly don’t know about.

You managed to hit the nail upon the top and also defined out the whole

thing without having side-effects , people can take a signal.

Will likely be back to get more. Thanks

It’s an amazing post for all the web visitors; they will obtain advantage from it I am sure.

Hello I am so delighted I found your webpage,

I really found you by error, while I was browsing on Askjeeve for something else, Anyhow I am